A new customer of UBB Bank goes through a fully remote identification and opens an account digitally in less than 11 minutes thanks to the integration with Evrotrust.

17 Oct 2023

Customer Stories

In the rapidly developing digital banking market, United Bulgarian Bank (UBB), part of the Belgian KBC Group, recognized the need to provide its customers with a convenient, secure, and modern banking experience. To achieve this, UBB chose the path of digital transformation by integrating Evrotrust's innovative technology into its mobile banking application UBB Mobile. Using Evrotrust's automated remote identification and e-signature services, UBB has created a fast and secure digital onboarding process that is available 24/7.

The Challenge: An easy process for signing up new clients

UBB set out to revolutionize the process of registering new customers, moving from traditional, time-consuming methods to a fully digital approach. The bank sought a solution that would simplify the onboarding process and ensure the highest level of security and compliance with regulatory requirements, including EU anti-money laundering (AML) directives. The challenge was to find a solution that would seamlessly integrate with UBB's existing systems, provide a convenient interface for customers, and facilitate the use of qualified electronic signatures (QES) to sign contracts.

The Solution: Evrotrust's identification and electronic signature platform

UBB found its solution in Evrotrust, a notified electronic identification scheme and a qualified provider of trust services under eIDAS. Evrotrust advanced technology offers a perfect combination of security, compliance, and elevated user experience. With the integration of Evrotrust into UBB Mobile, the bank enabled its customers to identify themselves and sign documents directly in the application through QES, which has the same legal value as a handwritten signature. This integration transforms the customer experience by making it fully digital, secure, and user-friendly.

The Implementation: Robust integration

The process of implementing the Evrotrust systems in UBB Mobile was carefully planned and executed. Identity verification via Evrotrust and electronic signature functionality were built in via SDK integration. Users scan an ID and take a biometric selfie with a liveness check to identify themselves and access a range of remote banking services. Users become customers of the bank in minutes by signing all the necessary documents with QES with just a few clicks on the smartphone.

The Results: A remarkable success

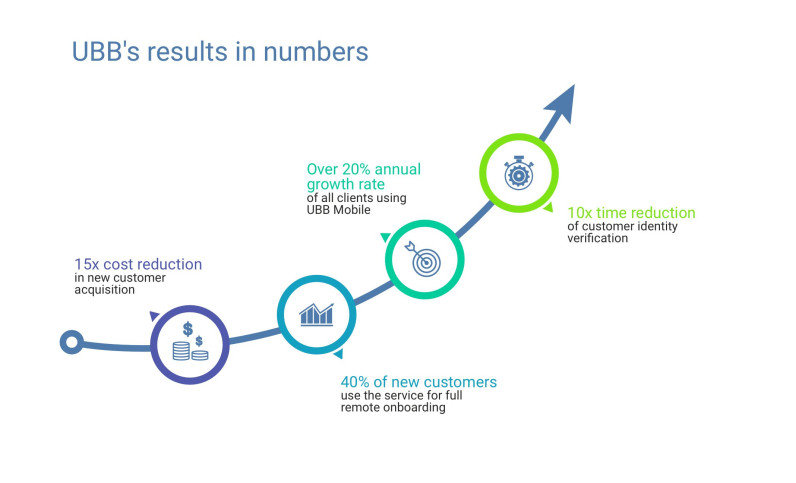

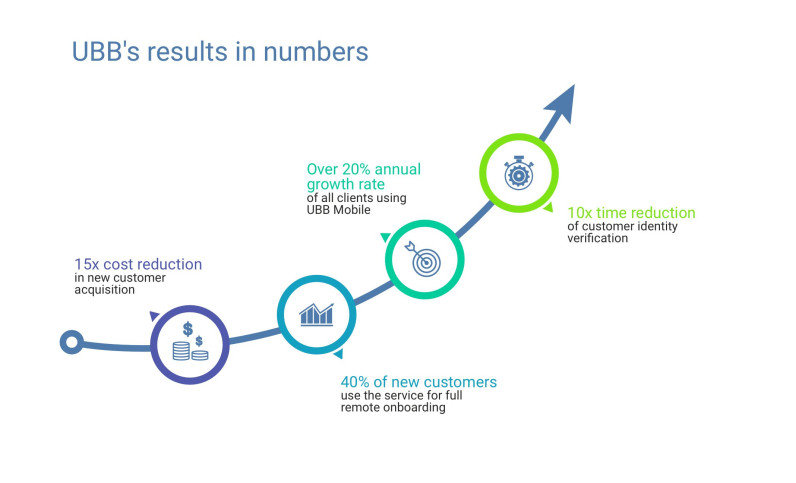

The integration of Evrotrust into UBB Mobile gave tangible results. New customers now can open an account without needing to physically visit a bank branch or sign paper documents. Adopting a fully digital process, UBB recorded a growth rate of over 20% on an annual basis in customers using UBB Mobile, one of the reasons being that on average 40% of the bank's new customers use the service for full remote onboarding. The time required to verify customer identity was dramatically reduced to less than 11 minutes, a significant 10x improvement over the previous onboarding process. In particular, the bank reduced the cost of attracting customers by 15 times, saving significant resources. Remote access to a wide range of banking services is also in line with UBB's commitment to sustainability by reducing the use of paper.

"Our ambition is for the number of UBB Mobile users to exceed 1 million and to be a digital leader in the banking market with the best customer experience. The process of digital onboarding of customers in mobile banking undoubtedly contributes to the achievement of this ambition of ours. Once logged into UBB Mobile, our customers have the full range of basic banking, insurance, investment and pension products and services on their smartphone, without the need to visit a bank branch. Thanks to the renewed and even more intuitive design, UBB Mobile is now identical to the mobile application of our Belgian parent company - KBC, which was declared the best banking application in the world in 2021 according to an independent survey among 151 banks from 22 countries in the world."

Tatyana Ivanova, Executive Director "Digitalization, Data and Operations" of UBB, innovation leader of KBC Group in Bulgaria

About UBB

For the last 15 years, since it has been operating in Bulgaria, the Belgian financial group KBC has invested 2.4 billion euros in the acquisition and development of some of the most significant local companies and projects, including the successive acquisition of DZI, CIBANK, UBB, the Bulgarian business of NN and Raiffeisenbank International. Thus, the Group became the largest integrated financial group in Bulgaria, serving its 2.2 million clients, and strengthened its position as one of the largest foreign investors in the Bulgarian economy.

UBB ranks first among the banks in Bulgaria in digitalization of its banking channels. This is according to the fifth edition of Deloitte's report on the digital maturity of the banking sector in 2022.

The bank focuses on the development of its unique bancassurance model, customer experience, sustainability and innovation. At the beginning of 2023, UBB celebrated the first year since the creation of its digital financial assistant Kate, which is accessible through mobile banking UBB Mobile.

www.ubb.bg